The Best Strategy To Use For Frost Pllc

The Best Strategy To Use For Frost Pllc

Blog Article

The smart Trick of Frost Pllc That Nobody is Discussing

Table of ContentsFrost Pllc for DummiesThe Best Strategy To Use For Frost PllcFacts About Frost Pllc RevealedThe Frost Pllc IdeasOur Frost Pllc Statements

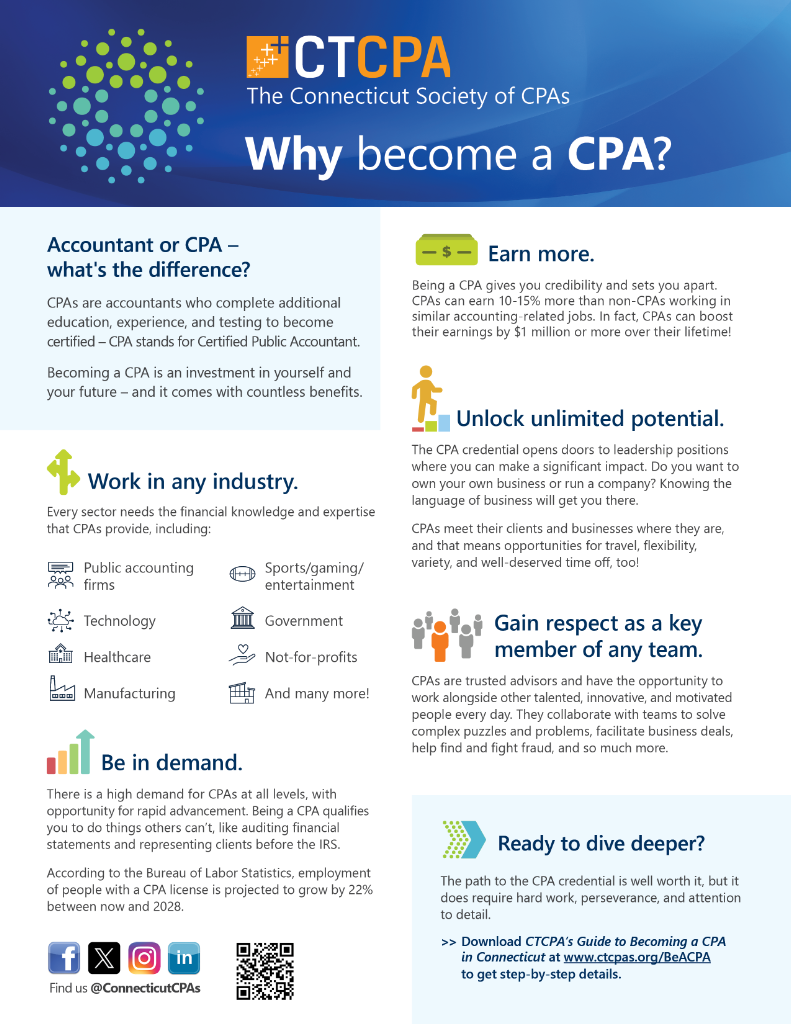

Certified public accountants are among one of the most trusted professions, and forever factor. Not only do Certified public accountants bring an unequaled level of understanding, experience and education to the process of tax preparation and managing your money, they are specifically educated to be independent and objective in their work. A CPA will certainly help you secure your passions, pay attention to and address your problems and, equally essential, give you comfort.In these important moments, a CPA can supply greater than a basic accountant. They're your relied on advisor, ensuring your service stays financially healthy and legitimately shielded. Employing a local CPA firm can positively impact your organization's financial health and success. Below are five key benefits. A regional CPA company can help decrease your organization's tax problem while making sure conformity with all applicable tax legislations.

This development shows our dedication to making a positive influence in the lives of our clients. When you work with CMP, you come to be component of our household.

Rumored Buzz on Frost Pllc

Jenifer Ogzewalla I have actually functioned with CMP for numerous years now, and I've really appreciated their know-how and efficiency. When bookkeeping, they function around my timetable, and do all they can to maintain connection of personnel on our audit.

Below are some crucial questions to guide your choice: Inspect if the certified public accountant holds an energetic permit. This guarantees that they have passed the essential examinations and fulfill high honest and specialist requirements, and it reveals that they have the qualifications to manage your monetary matters sensibly. Confirm if the certified public accountant uses solutions that straighten with your business demands.

Tiny organizations have unique financial needs, and a CPA with relevant experience can provide even more tailored advice. Ask regarding their experience in your market or with services of your size to guarantee they recognize your certain obstacles.

Clear up how and when you can reach them, and if they use routine updates or assessments. An accessible and receptive CPA will be invaluable for prompt decision-making and assistance. Working with a neighborhood CPA firm is greater than simply outsourcing monetary tasksit's a smart financial investment in your business's future. At CMP, with offices in Salt Lake City, Logan, and St.

Getting My Frost Pllc To Work

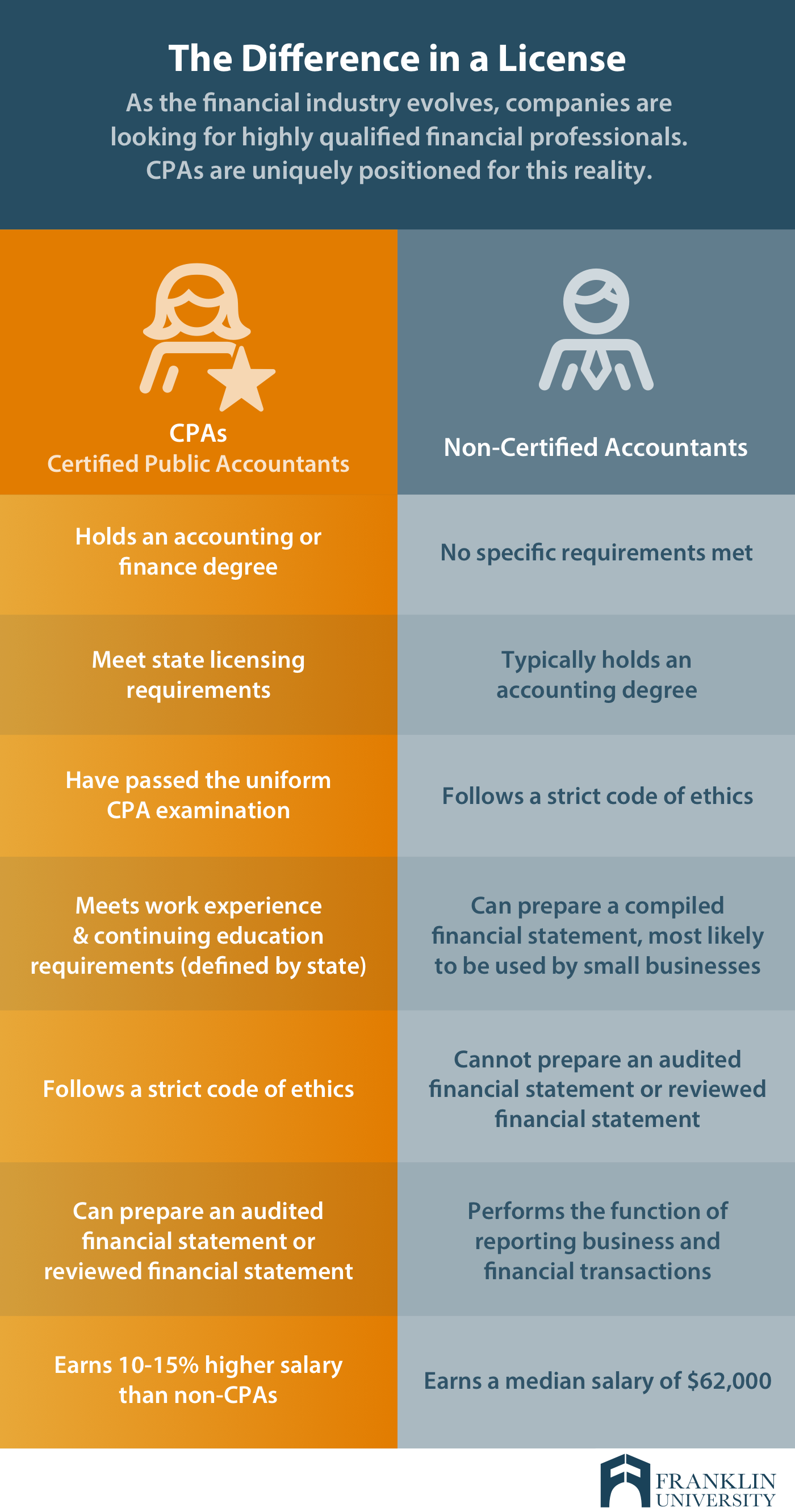

An accounting professional that has actually passed the CPA exam can represent you before the internal revenue service. Certified public accountants are accredited, accounting professionals. CPAs may benefit themselves or as part of a firm, relying on the setting. The price of tax obligation prep work might be reduced for independent professionals, but their expertise and ability may be much less.

documents to a firm that specializes in this location, you not only free on your own from this lengthy task, but you likewise totally free yourself from the threat of making mistakes that might cost you economically. You may not be making the most of all the tax cost savings and tax reductions offered to you. visit this site right here One of the most important concern to ask is:'When you save, are you putting it where it can expand? '. Numerous organizations have actually implemented cost-cutting procedures to decrease their general expense, however they have not place the money where it can aid business expand. With the aid of a certified public accountant firm, you can make the most informed decisions and profit-making techniques, considering the most current, updated tax obligation regulations. Federal government companies in any way levels call for paperwork and compliance.

The 10-Minute Rule for Frost Pllc

Handling this duty can be a frustrating task, and doing something incorrect can cost you both economically and reputationally (Frost PLLC). Full-service certified public accountant companies know with declaring requirements to ensure your click here for more info company follow government and state regulations, along with those of banks, capitalists, and others. You may need to report additional revenue, which may require you to submit a tax return for the very first time

team you can trust. Get in touch with us for more information concerning our solutions. Do you understand the audit cycle and the actions associated with ensuring proper financial oversight of your organization's economic well-being? What is your business 's lawful structure? Sole proprietorships, C-corps, S firms and collaborations are strained differently. The even more complicated your income sources, locations(interstate or worldwide versus local )and industry, the much more you'll require a CPA. CPAs have much more education and undertake a rigorous accreditation procedure, so they cost greater than a tax preparer or bookkeeper. Generally, local business pay between$1,000 and $1,500 to work with a CERTIFIED PUBLIC ACCOUNTANT. When margins are limited, this expenditure may beout of reach. The months gross day, April 15, are the busiest season for Certified public accountants, followed by the months prior to completion of the year. You might have to wait to obtain your inquiries addressed, and your tax obligation return can take longer to complete. There is a restricted variety of CPAs to go around, so you might have a tough time finding one especially if you have actually waited till the eleventh hour.

Certified public accountants are the" huge weapons "of the bookkeeping market and generally do not take care of day-to-day accountancy jobs. Often, these various other kinds of accounting professionals have specialties throughout locations where having a CPA certificate isn't called for, such as administration accountancy, not-for-profit bookkeeping, cost bookkeeping, federal government bookkeeping, or audit. As an outcome, using an audit solutions company is frequently a far much better value than working with a CPA

firm to company your ongoing financial continuous monetaryMonitoring

Certified public accountants additionally have know-how in developing and improving business policies and procedures and assessment of the useful demands of staffing designs. A well-connected Certified public accountant can leverage their network to aid the organization in various tactical and seeking advice from functions, efficiently connecting the company to the optimal candidate to fulfill their requirements. Following time you're looking to fill a board seat, consider reaching out to a CPA check it out that can bring worth to your company in all the means detailed above.

Report this page